The New Era of Markets-The Revival of Tariffs

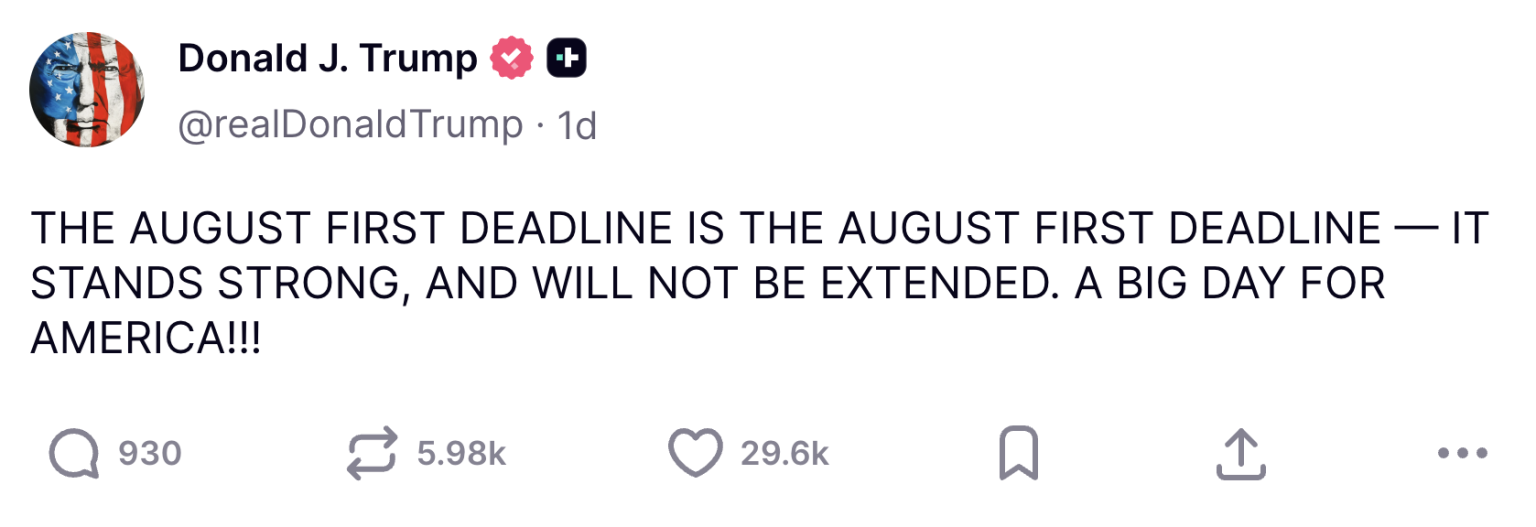

As the former President Donald Trump reinstated broad tariffs on imports by major trading partners- including Japan, South Korea, India, and the European Union, the financial world is filled with questions. How will this new trade war affect the fast-paced markets, particularly Bitcoin and the crypto market? The reactions are delicate, with short term explosiveness and long term possibilities.

Short-term Market Effect: Crypto Gets a Hit

The announcement of new tariffs changed the atmosphere in the crypto markets. Bitcoin fell below the $115,200 mark, and other major cryptocurrencies such as Ethereum, Solana, and XRP lost a lot of value due to increased economic uncertainty.

The overall crypto market cap lost nearly 4 percent in the hours after Trump announced his decision, with more than 300 billion dollars being erased as investors rushed to de-risk their portfolios.

This is typical sell-off that occurs when there is a risk-off sentiment: when fear sets in the traditional markets, riskier assets such as cryptocurrencies are often the first ones to suffer.

Why Crypto Drops when Tariffs Go Up

Tariffs do not apply to digital assets. Their general impact on the economy, however, which is to increase the cost of imports, to contribute to inflation, and perhaps to reduce growth, percolates through to all risk assets. When investors are nervous about international trade, they will move their money to what they think are safe havens (US dollars, bonds, sometimes gold)

Bitcoin, at least at this point, continues to behave like a risk asset: when volatility increases, a lot of traders sell crypto and move to stability.

One more underestimated effect: tariffs on tech-intensive countries can increase the price of mining equipment, which will put pressure on Bitcoin miners and reduce network security. This can also put additional pressure on the prices of cryptocurrencies in the short run

Final Thoughts

Although the tariffs introduced by Trump have sparked uncertainty again, the full effect of these tariffs on Bitcoin and crypto is yet to be realized in the coming months. History indicates that after the initial shock has passed, the particular benefits of crypto can emerge even stronger than before. The most important thing to remember as an investor is to keep yourself informed, mitigate risk, and never forget that even the most brutal markets are a chance to make money when you know the cycle.

Disclaimer: Crypto is a very risky asset class. This article is meant to be informational and not investment advice. You may lose all your capital.

Great news

ReplyDeleteIt's nice to hear

DeleteGreat news

ReplyDeleteYes it is

DeleteGood news for people

ReplyDeleteGreat

ReplyDeleteGreat news 👌

ReplyDeleteGreater news

ReplyDeleteNice

ReplyDeleteGreat

ReplyDeleteGreat

ReplyDeleteNice

ReplyDeleteGood news for people

ReplyDeleteHow to.

ReplyDeleteThis is lovely

ReplyDeleteNice

ReplyDeleteAwesome

ReplyDeleteAwesome

ReplyDeleteGoid

ReplyDeleteSuperb

ReplyDeleteNice

ReplyDeleteGood

ReplyDeleteGREAT NEWS

ReplyDeleteCrypto currency is always Rock, good news coming for crypto

ReplyDeleteVery good News

ReplyDeleteVery Good news

ReplyDeleteVery good news

ReplyDeleteVery good

ReplyDeleteVery nice

ReplyDeleteNice project trump

ReplyDelete